COMING SOON – WILL A NOW CONSIDERED RUTHLESS FSR MANAGEMENT QUEEN, AND A WAVERING AND RESIGNED BOARD PRESIDENT CONTINUE THEIR USURPATION AND BULLYING OF THE LAKESIDE POOL COMMITTEES?

There’s so much to tell. First, let’s set the table to understand a situation that totally shows the majority Board of Directors behavior to withstand and, hopefully for them, silence dissent to their actions.

A dissenting Resident has been marked, where the Board’s misinformation, false accusations, and refusing to respond, have been used to bully the Resident into silence. The matter involves the payment of an assessment that has been tagged late. First Service Residential’s (FSR) in-house staff are the source of this attack, behaving as the majority Board’s shills.

The assessment involved has three payments due on the first of three consecutive months (August, September, and October), with a 30-day Grace Period for the payments. The Resident made the last payment on October 31, which is the 30th day of the Grace Period. A Grace Period commences after the due date, which would be October 1. The Grace Period is therefore October 2 through October 31. The payment was made, as directed by FSR, through its website, where you can pay $3.00 to make the payment through Click Pay. Your bank information is accessed in the FSR site, and you click Make Payment, and your payment is made. You receive a payment confirmation number and the date of the payment, i.e. October 31.

This described process is used to pay credit cards, mortgage payments, and various loan payments. Further, payments by postmarked mail follow the same pattern, i.e. the date postmarked mailed is the day of the payment, e.g. your IRS Return and payment.

If you call FSR and Click Pay, then the customer service folks tell you the payment is considered made on the date you click and pay on the FSR site, or by mail, on the postmarked mail date.

However, the Resident’s October assessment payment was tagged late that was made on October 31 by the FSR in-house staff, who insisted the payment should have been made on October 30. The Resident disputed the tagged late payment as described above. The staff did not explain why the October 31 payment procedure by the Resident was considered late, other than providing misinformation that the Grace Period is 30 days per month, ignoring the provided definition that it commences after the due date, making the October 31 payment made on time. Further, the staff stated that the payment was posted to FSR’s ledger on November 2. Remember, after a payment, you receive an immediate notice that the payment has been submitted with a confirmation number and a date. There is no disclosure in the FSR site that a payment made on its site is only considered paid at posting. The person making the payment has no control of the posting date. Keep in mind that the ACSA Board employs FSR and its staff, and makes the rules on payments.

In the ACSA Budget, have you seen income from paid late fees? Hmm. The Resident requested a waiver of the late fees from the ACSA Board, now piling up over $200, since the FSR staff refused to have a discussion of the matter. When a meeting was requested with the staff, the request was ignored again.

At the ACSA Hearing to waive the fees, none of the information provided to the Board by the Resident was addressed or discussed by the Board, i.e. the misinformation on the Grace Period definition, and why the October 1 payment was on time, per the FSR site and its Customer Service Department. At the Hearing, the FSR staff member was provided time for her false reasoning for the late payment, stating how the attorneys would consider not agreeing to her mis-information and false information as setting a bad precedent for payments. There was no discussion about the Resident’s information, which was all true, but not to be heard. The majority Board of Directors, following the Property Manager’s falsely substantiated opinion, as always, then voted not to waive the Late Fees.

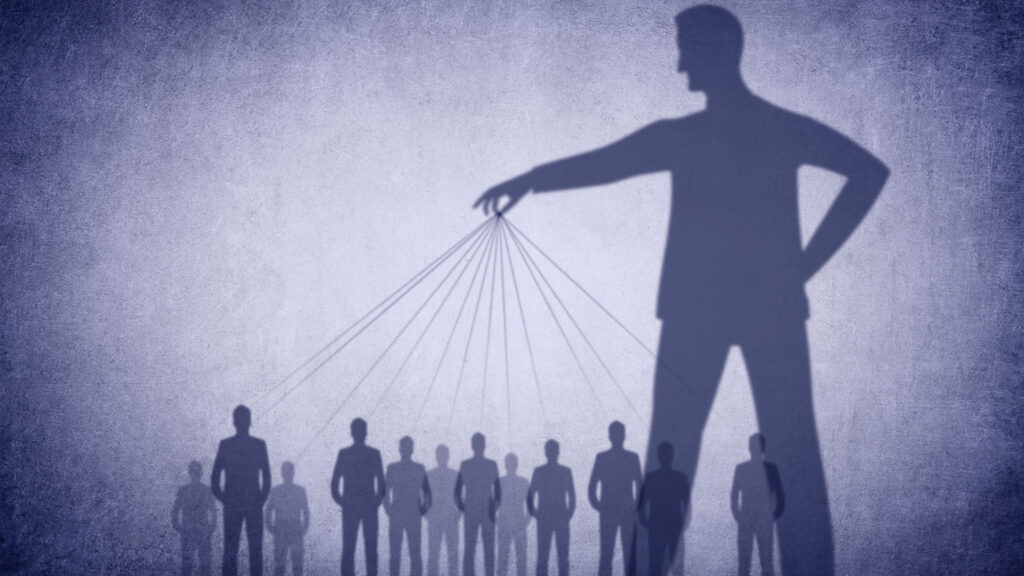

It’s obvious now that the majority Board feels it reigns with impunity for any of its actions, even at the expense of ignoring the truth to secure its selfish goals, in this recent case, taking money from a Resident with false pretenses, to obviously set an example by exemplifying its bullying behavior.

This should be a forewarning to the community at what length the majority Board will take to implant its will on the Residents. The longtime Property Manager has honed her position to basically call the shots. It’s ironic that this non-Resident paid employee has her court, i.e. the majority Board of Directors, depend on her for community matters, and direction when it’s baffled what to do. The bullying of a Resident was invited and allowed to occur by the majority Board, with no discussion otherwise. She also has bullied the Pool Residents on how the Lakeside Pool would be renovated, dictating to them what would be done and how much the Residents would pay. The Residents’ input was ignored to an alternative and more cost-effective approach. The majority Board, which behaves as her compliant court, let her take control, in spite of the Pool Residents’ wishes.

It’s also interesting that for the first time in memory not one Resident offered an application to run for office as a, ACSA Director for this coming election. Why? Hmm. Four positions are open, with two current Directors running with no opposition, resulting in no need for Resident voting. The remaining two vacant positions will be filled by Board selection. From a political perspective, selection of like-minded folks would be expected to create a majority voice for the Board of Directors. With no Director candidates, and voting by Residents now not needed, and an unfortunate selection process would prevail. Hmm.

Again, be forewarned, at what length the majority Board of Directors will stoop, to fulfill their goals, to gain social acceptance, and to silence their dissenters. Are these the people, who took an oath of allegiance for the betterment of the community, who the Residents elected to practice a fiduciary duty for them, and who are expected to act in the best interest of its Residents? Apparently not. What we have is a Deep State cabal of self-serving minions.

Late breaking news is that with an election Board Meeting a day away, the quorum to hold a meeting is only 2/3’s complete. That coupled with fact that no Residents applied to run as Directors tells you everything you need to know about the respect the Residents have for their majority Board.

What we need to do is secure a new professional management company for Aquarina from which sub-management companies could be selected for the golf, the tennis, and the restaurant. The restaurant should be leased, and be self-supporting with no community subsidies. The AGI cabal, which is a self-serving entity, uses the Residents’ maintenance fees to support its selfish goals of offering a subsidized social entertainment network to its participating Residents.

We don’t need non-professional golf management Residents, non-professional restaurant management Residents, and non-professional tennis management Residents to run these amenities. We do need to hire professional management companies for each of these revenue sources. A Board of Directors can oversee these three amenities, not run them. The Board can monitor the negotiated fees these management companies would pay the ACSA from the profits they would be expected to earn from these Aquarina amenities.

The Board could spend its time taking care of the Aquarina Community, and not the three Aquarina owned amenities for its own purposes. The entanglement of these amenities and the running of a community by a Board of Directors, as we have seen, leads to where the politics and the current generated revenue result to provide a fertile ground for the collusion of both the politics and the revenue. This collusion is overseen and is driven by selfish cabal (Deep State) goals, has no impartial oversight, and the whole Aquarina Community suffers.

A change is needed. Soon.